Crypto Price: Exploring Percentages

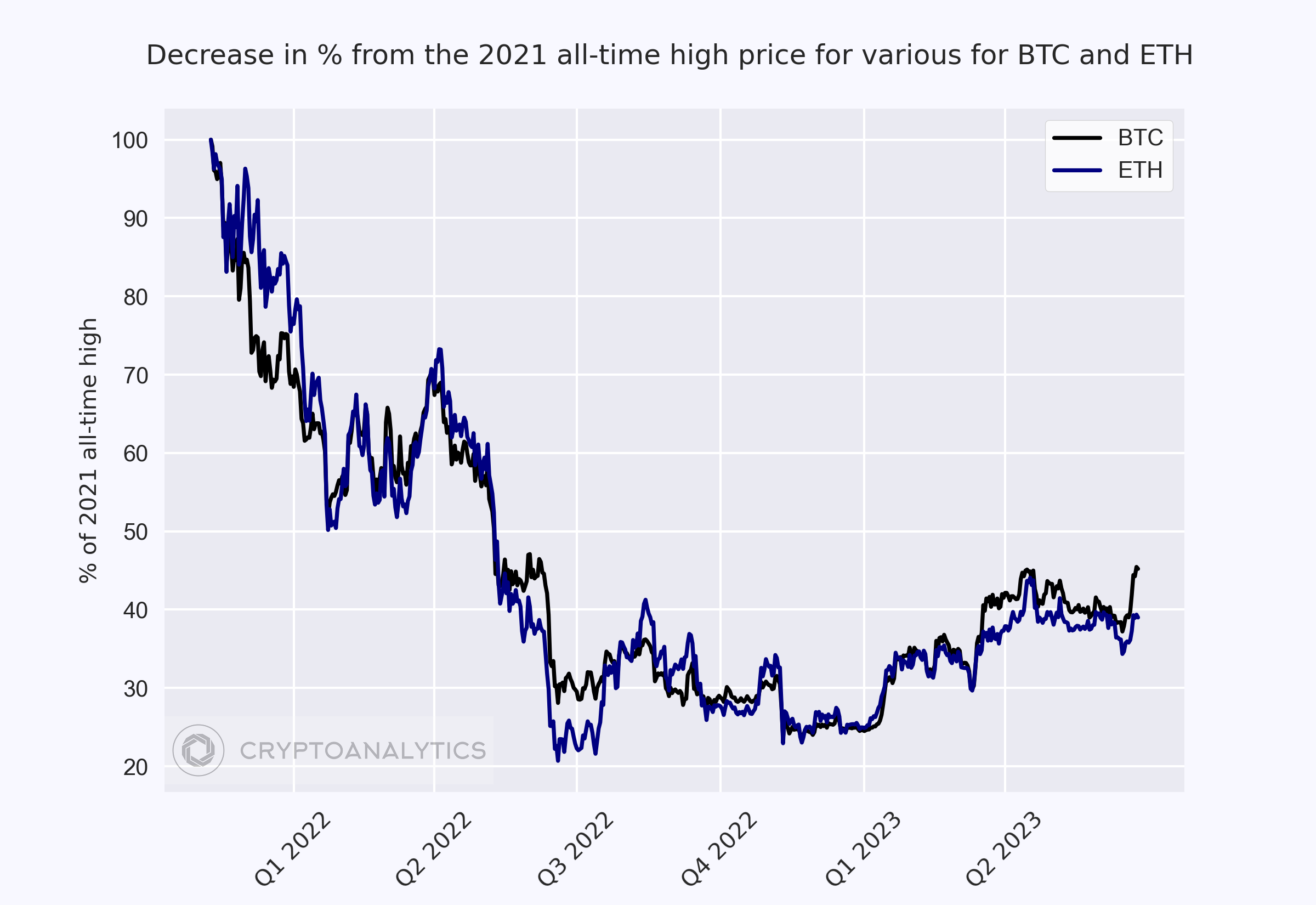

In this article, we study the relationship between the decrease and the increase in cryptocurrency prices in terms of percentages. This serves as a basis for understanding future articles. This subject is frequently discussed but is often misunderstood by both beginner and advanced traders. It is indeed impossible for one's capital to decrease by more than 100% because there would be no capital left if the price falls to 0. However, a price can increase beyond 100% or more than double. The first graph shows the percentage decrease for ETH and BTC from their highest prices in 2021.

A simple exercise is to observe that if a price falls by 50%, it must now double to reach its highest price again. The calculation is represented as 1 divided by the percentage decrease's inverse: 1/(100%-50%) = 2. Thus, we can calculate by how much the price must be multiplied to return to the highest price. This multiplier is presented below for BTC and ETH.

The larger the decrease, the higher the multiplier. For example, with a 75% decrease, the price must be multiplied by 4 to return to the same price. At first glance, 75% seems to be only 25% more than 50%. However, for the price to decrease by 75%, it represents two consecutive 50% decreases. For instance, if the price of BTC is $100,000, the first 50% decrease would give $50,000, and a second decrease from this new price would be $25,000, which also represents a 75% decrease from the initial price. Similarly, the price must double and double again to return to the initial price, resulting in a 4x multiplier. If we include a much more volatile cryptocurrency like ADA in the graph, we realize that the larger the decrease, the higher the price must be multiplied to regain the same value. Thus, a decrease between 50% and 75% represents a multiplier of 2x to 4x for a return to the highest price (a difference of 2x), but a decrease of 75% or 90% represents a multiplier of 4x to 10x (a difference of 6x).

By examining the decreases of several altcoins (next figure), we notice that the multipliers are higher when the decrease is significantly larger. If we expect the price to reach its highest point again, it is evident that betting on altcoins will be profitable because the multiplier is much higher. However, an altcoin that constantly falls and reaches 0 will have a multiplier that represents infinity. Nevertheless, the probability of reaching the highest price again is 0. Therefore, investing in such a coin remains a very bad idea.

Several topics are important to understand the dynamics between the rise and fall of prices in cryptocurrencies. For example, what is the difference between reaching the highest point in terms of price or in terms of the total market capitalization? What is the probability that an altcoin will reach its highest price compared to the probability for a less volatile coin like BTC and ETH? We can also observe that several altcoins had higher values before BTC, while many claim that the price of altcoins follows the increases in BTC's price. What does this phenomenon imply? We will discuss these important topics in the future.

The figures were created with the help of the matplotlib library.